Introduction

Introduction

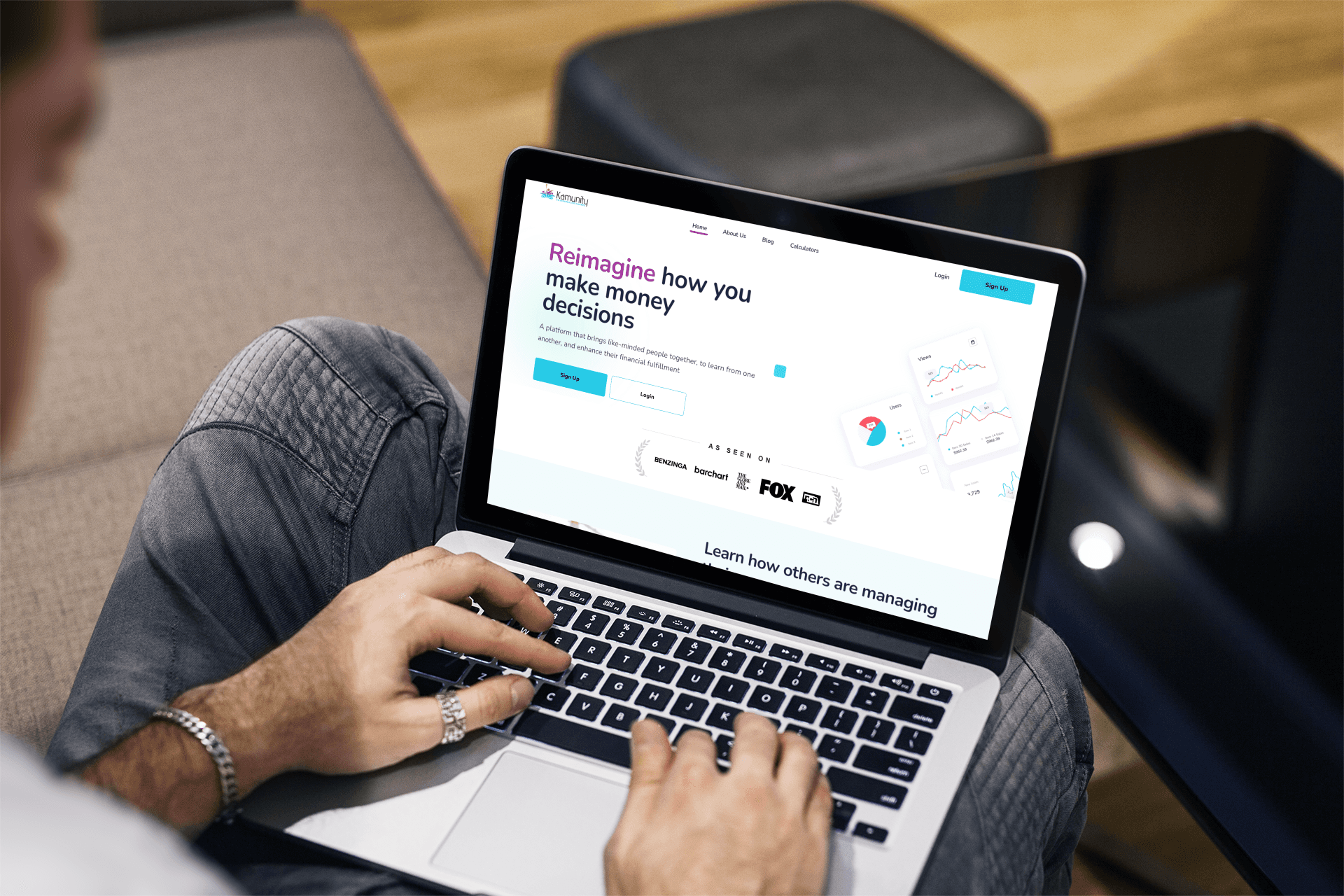

Kamunity.io is all about empowering people to master their finances together. Think of it as a community-driven platform where financial knowledge is made easy and accessible for everyone. The goal is to provide a clear, real-time snapshot of your finances, so you can make smarter decisions.

Goal

Users want to learn about finance, track their expenses and savings, and cut down on unnecessary spending. Kamunity.io makes this happen by linking your bank accounts and credit cards, tracking your transaction history, and using machine learning to offer personalized advice.

Engage

Explore, Share, and

Grow with Like-Minded Peers

Ignite

Discover Financial

Strategies from Your Kamunity

Data Driven

Real Data

Real users

Addressing Challenges with Clear Solutions

So here's what I gathered from talking to users

People want to learn how to manage their finances better.

They’re looking for a single platform to track all their expenses and savings.

They want to find ways to cut down on unnecessary spending.

Key Takeaways

We'll link users' bank accounts to automatically fetch their data.

We’ll also connect their credit cards to track spending and send reminders.

By tracking their transaction history, we can show them their earnings and spending patterns.

And finally, we'll use machine learning to offer personalized tips to help them save more and spend less.

Addressing Challenges with Clear Solutions

To personalize the experience, we collect information about users' financial goals and spending habits, which helps tailor the app’s insights and recommendations.

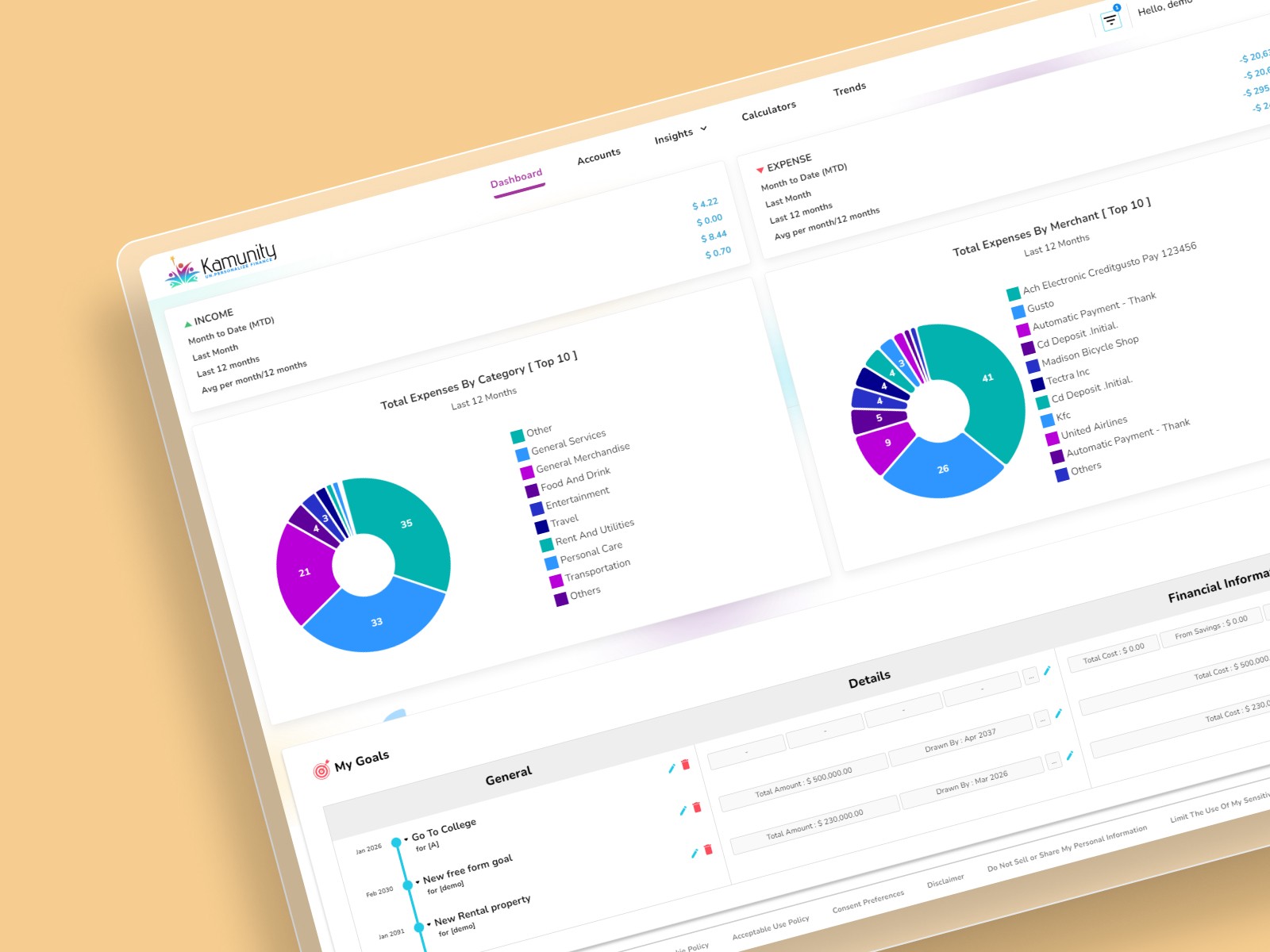

Users can quickly review all linked account balances and recent transactions, promoting effortless financial management. Visual progress tracking towards financial goals like saving or debt reduction keeps users motivated.

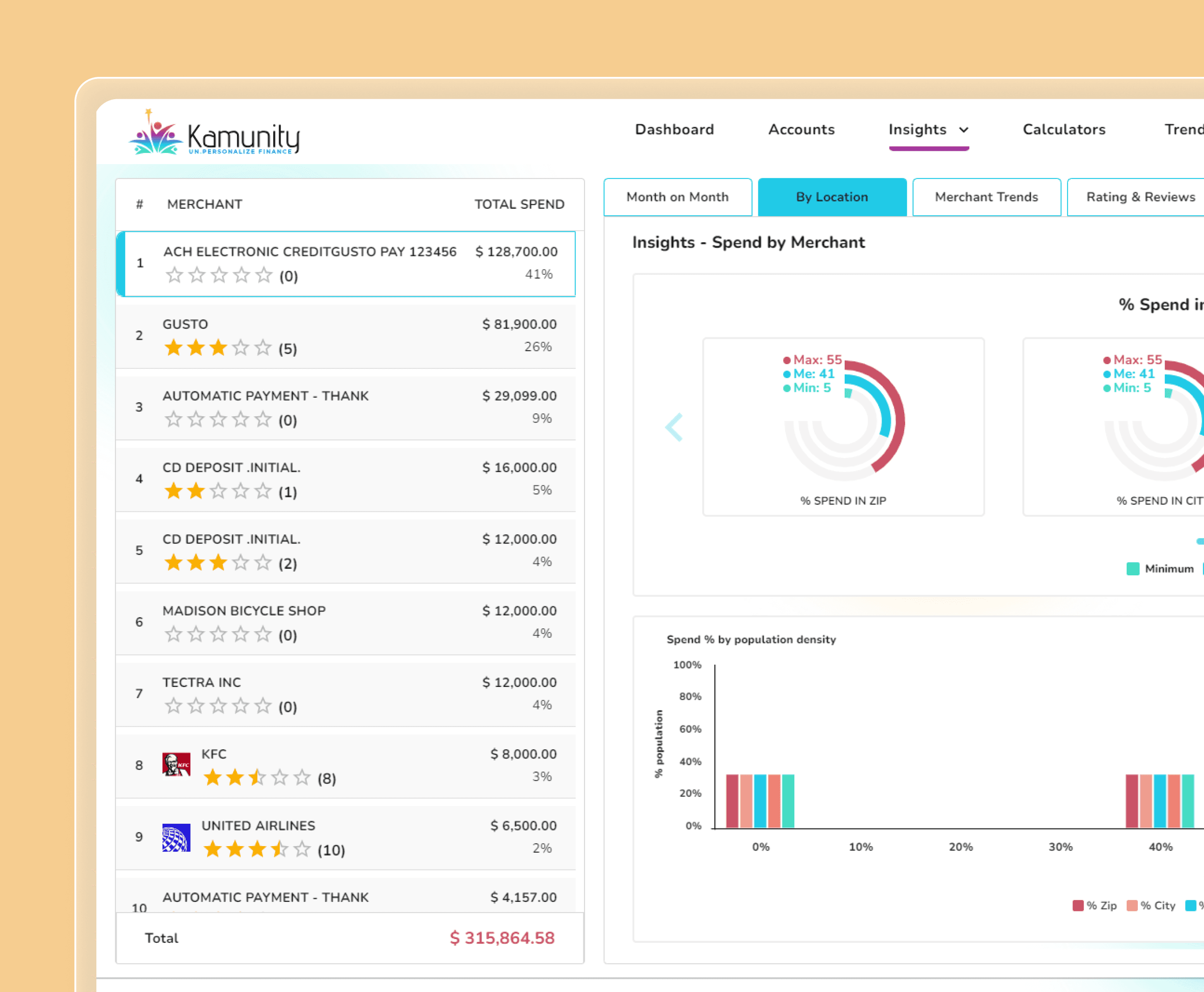

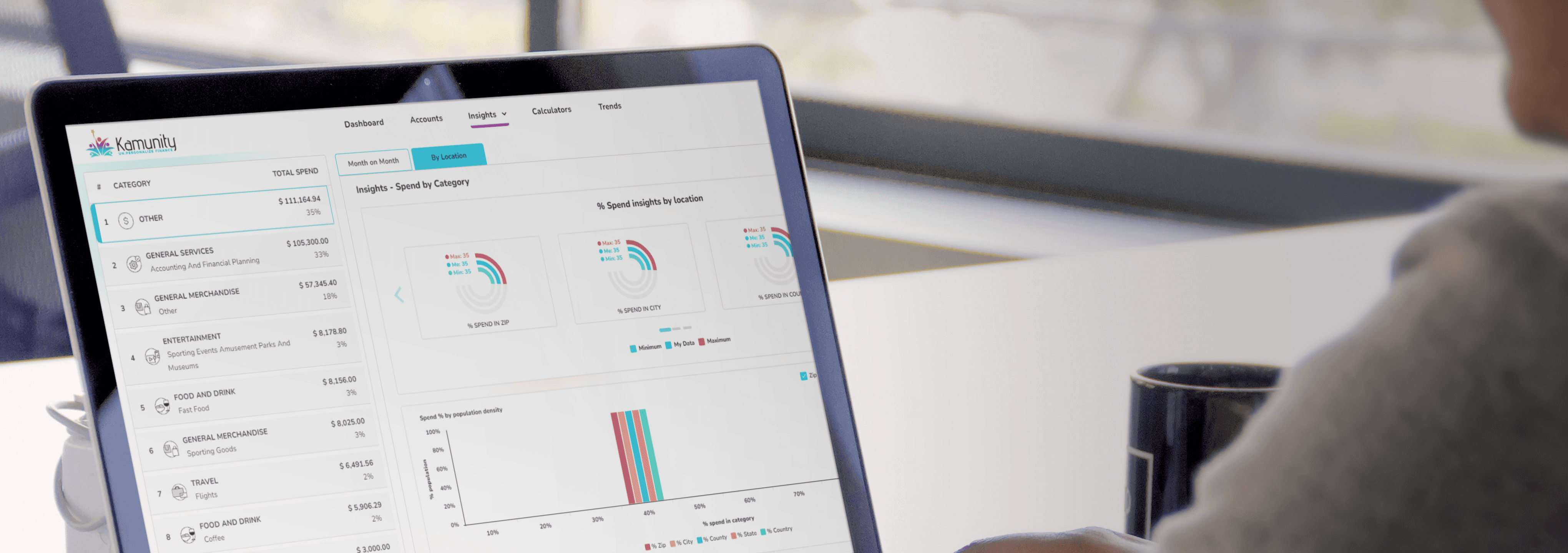

Detailed insights include a breakdown of spending by category presented with trend charts, enabling users to recognize spending patterns. Merchant ratings add further value, helping users make informed decisions.

Timely alerts help users avoid overspending and manage upcoming bills more effectively by highlighting unusual spending and budget limits .

AI-generated recommendations provide personalized financial advice, identifying opportunities for budget adjustments and savings, while tailored educational content enhances financial literacy.

Design Process

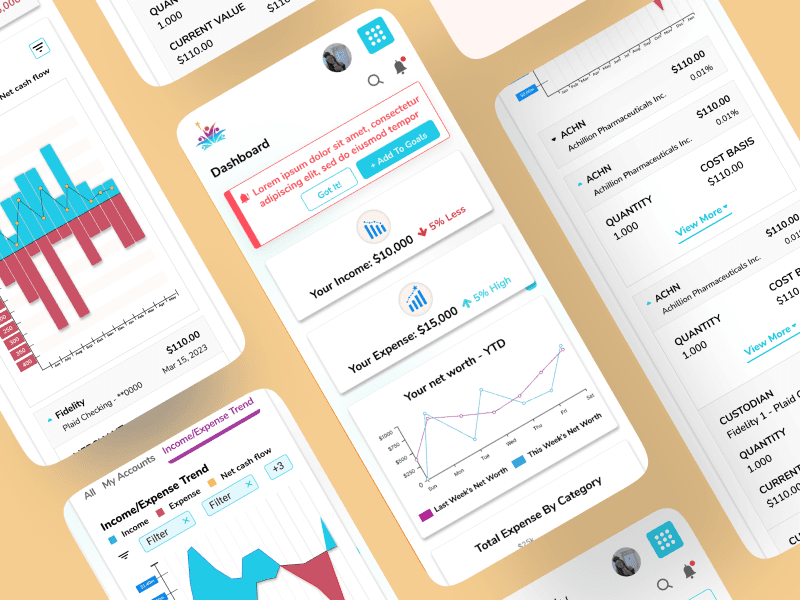

In designing , I focused on creating a clean, intuitive dashboard layout.

The dashboard provides a snapshot of financial status through summary charts of total expenses and income, along with top expense categories.

Spend-by-category views incorporates visual charts, merchant ratings and account-linking processes are made smooth and clear visual aids.

Kammunity features are designed to be easily accessible and integrated into the webapp.

Regular usability testing and feedback loops allowed us to iteratively refine the app, ensuring it evolves with user expectations and technological advancements thus, remaining valuable and engaging.

User Journey

Onboarding

Sign-Up: Users start by creating an account, providing basic information like name, email, and a secure password.

Personalization: Users are asked about their financial goals, spending habits, and preferred financial tools (e.g., bank accounts, credit cards) to tailor their experience.

Dashboard Overview

Overview: Upon logging in, users see a dashboard displaying their total income, expenses, and net worth through easy-to-understand summary charts.

Financial Goals: Users can set and track goals such as saving for a vacation or paying off debt, with progress bars and motivational prompts.

Expense Tracking

Detailed Breakdown: Users can view their spending by category (e.g., groceries, entertainment) with visual charts.

Transaction History: A comprehensive list of recent transactions helps users keep track of their finances.

Personalized Advice

AI Recommendations: The platform uses machine learning to offer tailored advice on how to save more and cut unnecessary expenses.

Alerts and Notifications: Users receive alerts about unusual spending, upcoming bills, and budget limits.

Security and Privacy

Data Protection: The platform ensures users’ financial data is securely handled and stored, with transparent privacy policies.

Other useful features that make this interesting

Peer Interaction

Users can join groups with similar financial goals.

Sharing tips and experiences with the community.

Merchant Ratings

Ratings and reviews for merchants to help users make informed spending decisions.

Alerts and Notifications

Notifications for unusual spending and approaching budget limits.

Reminders for upcoming bills and payments.

Conclusion

In summary, my work on Kamunity.io has demonstrated the power of combining user-centric design with cutting-edge technology to address everyday financial challenges. By deeply understanding user needs, we built an intuitive and secure platform that simplifies financial management, fosters community engagement, and provides personalized insights. This journey has not only improved users’ financial literacy but also empowered them to make smarter financial decisions with confidence.